Diamond investment has been valued for centuries due to its durability, intrinsic value, and aesthetic appeal. Diamonds are not only symbols of luxury and status but also tangible assets that can preserve and increase in value over time. This long-standing tradition of investment has been maintained for several key reasons:

- Durability and Stability: Diamonds are extremely hard and resistant, ensuring they maintain their beauty and value over time. This physical durability translates to economic stability, making diamonds less susceptible to rapid devaluation compared to other goods.

- Intrinsic Value: Unlike investments based on fiat currencies or digital assets, diamonds possess intrinsic value. Their rarity and constant market demand ensure that diamonds retain their value over time. Additionally, colored diamonds, especially rare ones like red diamonds, can reach significantly high prices, increasing their appeal as an investment.

- Aesthetic Appeal: The brilliance and clarity of diamonds make them highly desired gemstones. Their visual appeal is not only appreciated in jewelry but also increases their value as collectible items and symbols of wealth.

In this post, we will explore in detail how to invest in diamonds, the key factors you should consider before making a purchase, and answer some frequently asked questions. Our goal is to provide you with the necessary information to make informed and safe decisions when considering diamonds as an investment option.

Why Invest in Diamonds?

Investing in diamonds offers several advantages that make them an attractive option for diversifying and protecting wealth. Here are some of the most important reasons to consider this investment:

Durability and Stability

Diamonds are known for their extreme hardness, being the hardest material on the Mohs scale. This property allows them to resist wear and retain their brilliance and appearance over time. Unlike other assets, diamonds do not deteriorate, ensuring they will maintain their value for many years. Additionally, the stability of the diamond market, despite global economic fluctuations, makes them a safe and reliable investment.

Intrinsic Value

One of the most notable characteristics of diamonds is their intrinsic value. Unlike currencies or real estate, diamonds have a value that does not depend on government decisions or economic conditions. This value comes from their rarity, beauty, and the high constant demand in global markets. Diamonds, especially those of high quality and significant size, will always have a market willing to pay a premium price due to these qualities.

Portability

Diamonds are exceptionally portable compared to other forms of investment. A small stone can have an extremely high value, making it easy to transport and store. This is particularly useful in situations where mobility and discretion are important. Being compact and lightweight, diamonds offer a convenient and safe way to store and transfer large sums of value without the risks associated with transporting large amounts of cash or real estate.

Portfolio Diversification

Investing in diamonds also allows for portfolio diversification. Adding diamonds to a portfolio that includes stocks, bonds, and real estate can reduce overall risk due to the low correlation of diamonds with other financial assets. This diversification protects against losses in a specific market sector, offering greater stability and financial security.

Inflation Protection

Diamonds have proven to be a good protection against inflation. As the value of money decreases, the value of diamonds tends to increase, as the demand for tangible goods like diamonds rises. This means that diamonds can maintain and increase their value in times of inflation, protecting the investor’s purchasing power.

Tax Exemption and Fiscal Benefits

In some countries, diamond investments can offer fiscal benefits. For example, diamonds may be exempt from certain capital gains or inheritance taxes, depending on the jurisdiction. It is important to consult with a tax advisor to understand the specific tax implications in your region, but generally, diamonds can offer additional advantages from a fiscal perspective.

Types of Diamonds for Investment

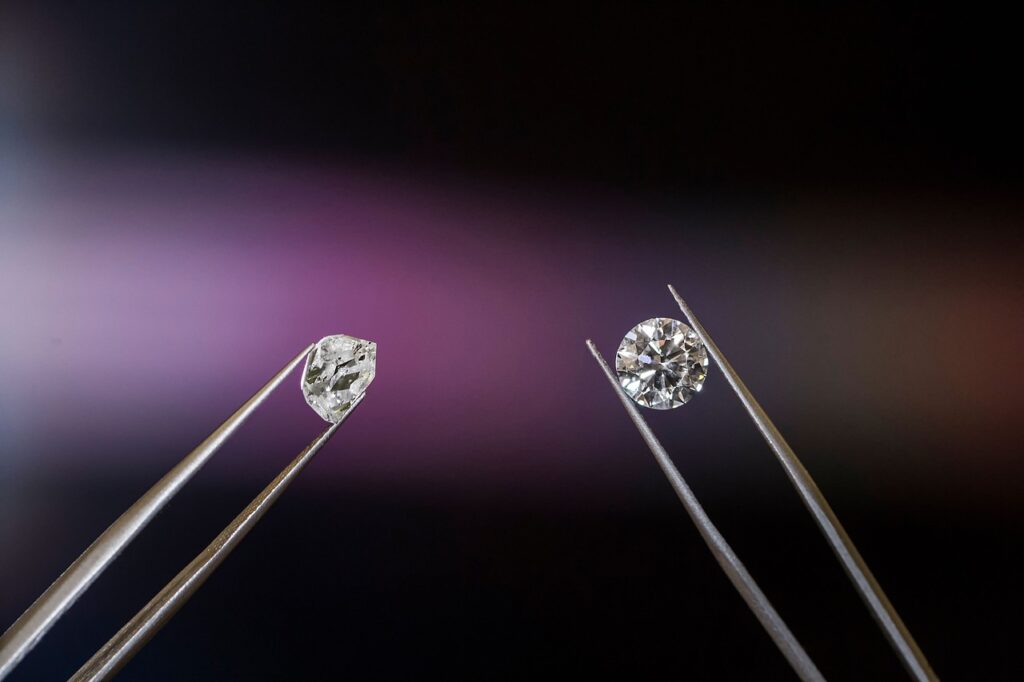

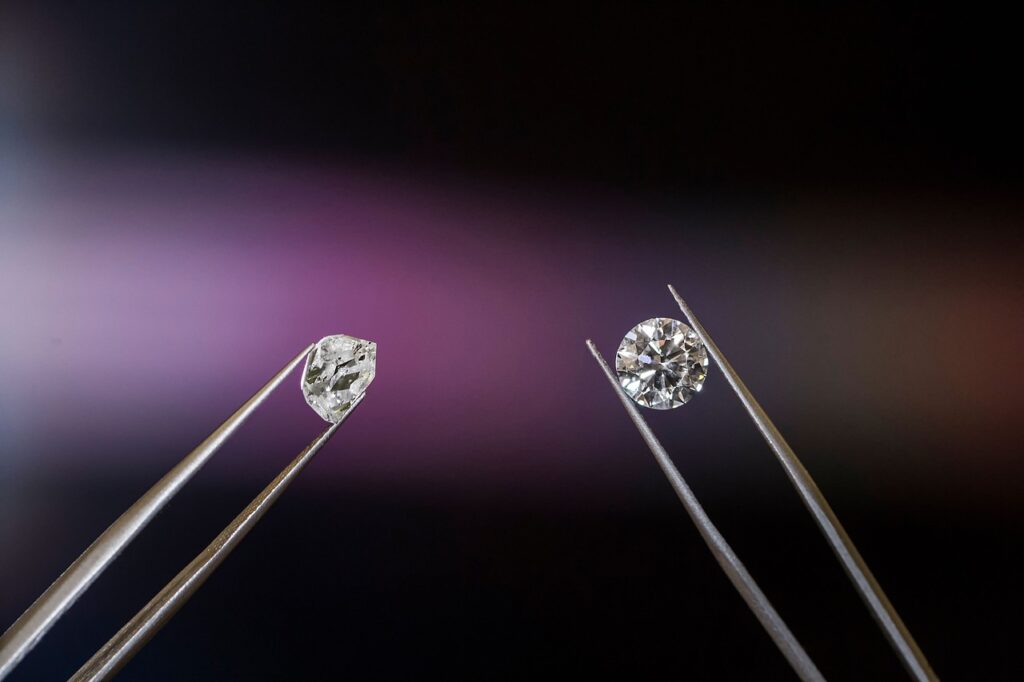

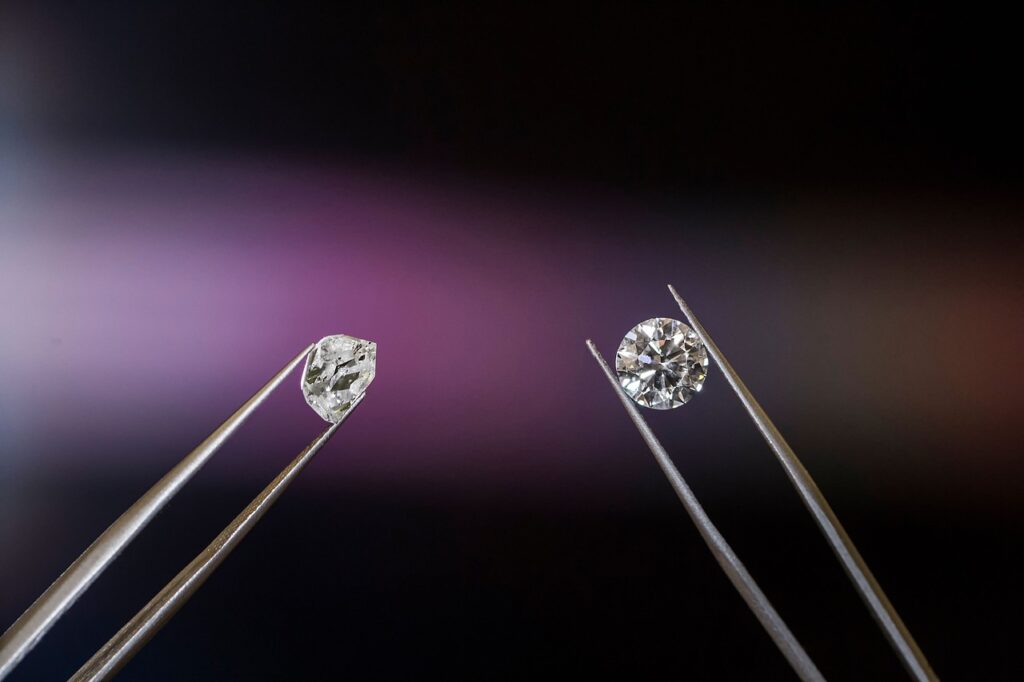

When considering diamond investment, it is crucial to understand the differences between natural and synthetic diamonds. Natural diamonds are more expensive due to their origin and rarity, while synthetics, though similar in appearance, are created in laboratories and generally cost less. The latter may not have the same resale value or appeal to collectors.

For more details on this topic, check out our guide on differences between natural and artificial diamonds.

Natural Diamonds

Natural diamonds form over millions of years under extreme pressure and temperature conditions in the Earth’s mantle. This natural formation makes them extremely rare and valuable. Natural diamonds are often preferred by investors due to their authenticity, durability, and potential to appreciate in value over time. The history and provenance of a natural diamond can also add significant value, especially if they come from recognized and ethically responsible mines.

Synthetic Diamonds

Synthetic diamonds, also known as lab-created diamonds, are produced through processes that replicate the conditions under which natural diamonds form in the Earth. Although these diamonds are chemically and physically identical to natural ones, their market value is lower. Technological advances have made synthetic diamonds increasingly common, which may influence their future value. However, their lower cost can be attractive for certain short-term investments.

Colored Diamonds

In addition to traditional white diamonds, colored diamonds, especially rare ones like red diamonds, are highly valued and sought after. Colored diamonds form when certain chemical elements are present during their formation, giving them unique colors. For example, red diamonds are extremely rare and can reach extraordinary prices in the market due to their beauty and scarcity.

Learn more about red diamonds, one of the rarest and most valuable diamonds.

Factors to Consider When Choosing Diamonds for Investment

Investing in diamonds requires careful evaluation of several factors to ensure your investment is solid and profitable. Here are the key aspects you should consider:

Rarity

The rarity of a diamond is one of the most determining factors of its value. Intensely colored diamonds and large diamonds are especially rare and, therefore, more valuable. The scarcity of these diamonds in the market increases their demand and, consequently, their price.

Intensely Colored Diamonds: Diamonds such as red, blue, and green are extremely rare. For example, red diamonds are among the rarest and can reach exorbitant prices due to their scarcity and visual appeal.

Large Diamonds: Diamonds that exceed 5 carats are much rarer than smaller diamonds. These large diamonds are usually more attractive to collectors and investors due to their notable presence and superior value.

Quality of the 4Cs

The 4Cs — Cut, Color, Clarity, and Carat weight — are the fundamental criteria for evaluating the quality and value of a diamond. Each of these factors significantly contributes to the overall value of the diamond.

Cut: The quality of the cut affects the diamond’s ability to reflect light and, therefore, its brilliance. An excellent cut can significantly enhance the beauty of a diamond, making it appear larger and more brilliant.

Color: Colorless diamonds (grade D on the color scale) are the most valuable. As color becomes more noticeable (from E to Z on the scale), the diamond’s value generally decreases, except in the case of intensely colored diamonds, which can be very valuable due to their rarity.

Clarity: Clarity measures the internal and external imperfections of the diamond. Diamonds with fewer inclusions and defects are more valuable. Clarity grades range from Flawless (without imperfections) to Included (with visible inclusions to the naked eye).

Carats: The carat is the unit of weight for diamonds. One carat equals 200 milligrams. Diamonds with a higher carat weight are rarer and, therefore, more valuable. However, two diamonds of the same carat weight can have different values depending on their cut, color, and clarity.

If you want to learn more about the 4Cs, visit our section – The Quality in 4Cs

Diamond Certification

Ensure that the diamond is certified by a recognized entity such as the GIA (Gemological Institute of America) or the AGS (American Gem Society). Certification provides an independent and accurate assessment of the diamond’s quality, which is crucial for determining its real value. A gemological certificate describes the diamond’s characteristics and guarantees its authenticity, protecting your investment### Diamond Investment

Diamond investment has been valued for centuries due to its durability, intrinsic value, and aesthetic appeal. Diamonds are not only symbols of luxury and status but also tangible assets that can preserve and increase in value over time. This long-standing tradition of investment has been maintained for several key reasons:

- Durability and Stability: Diamonds are extremely hard and resistant, ensuring they maintain their beauty and value over time. This physical durability translates to economic stability, making diamonds less susceptible to rapid devaluation compared to other goods.

- Intrinsic Value: Unlike investments based on fiat currencies or digital assets, diamonds possess intrinsic value. Their rarity and constant market demand ensure that diamonds retain their value over time. Additionally, colored diamonds, especially rare ones like red diamonds, can reach significantly high prices, increasing their appeal as an investment.

- Aesthetic Appeal: The brilliance and clarity of diamonds make them highly desired gemstones. Their visual appeal is not only appreciated in jewelry but also increases their value as collectible items and symbols of wealth.

In this post, we will explore in detail how to invest in diamonds, the key factors you should consider before making a purchase, and answer some frequently asked questions. Our goal is to provide you with the necessary information to make informed and safe decisions when considering diamonds as an investment option.

Why Invest in Diamonds?

Investing in diamonds offers several advantages that make them an attractive option for diversifying and protecting wealth. Here are some of the most important reasons to consider this investment:

Durability and Stability

Diamonds are known for their extreme hardness, being the hardest material on the Mohs scale. This property allows them to resist wear and retain their brilliance and appearance over time. Unlike other assets, diamonds do not deteriorate, ensuring they will maintain their value for many years. Additionally, the stability of the diamond market, despite global economic fluctuations, makes them a safe and reliable investment.

Intrinsic Value

One of the most notable characteristics of diamonds is their intrinsic value. Unlike currencies or real estate, diamonds have a value that does not depend on government decisions or economic conditions. This value comes from their rarity, beauty, and the high constant demand in global markets. Diamonds, especially those of high quality and significant size, will always have a market willing to pay a premium price due to these qualities.

Portability

Diamonds are exceptionally portable compared to other forms of investment. A small stone can have an extremely high value, making it easy to transport and store. This is particularly useful in situations where mobility and discretion are important. Being compact and lightweight, diamonds offer a convenient and safe way to store and transfer large sums of value without the risks associated with transporting large amounts of cash or real estate.

Portfolio Diversification

Investing in diamonds also allows for portfolio diversification. Adding diamonds to a portfolio that includes stocks, bonds, and real estate can reduce overall risk due to the low correlation of diamonds with other financial assets. This diversification protects against losses in a specific market sector, offering greater stability and financial security.

Inflation Protection

Diamonds have proven to be a good protection against inflation. As the value of money decreases, the value of diamonds tends to increase, as the demand for tangible goods like diamonds rises. This means that diamonds can maintain and increase their value in times of inflation, protecting the investor’s purchasing power.

Tax Exemption and Fiscal Benefits

In some countries, diamond investments can offer fiscal benefits. For example, diamonds may be exempt from certain capital gains or inheritance taxes, depending on the jurisdiction. It is important to consult with a tax advisor to understand the specific tax implications in your region, but generally, diamonds can offer additional advantages from a fiscal perspective.

Types of Diamonds for Investment

When considering diamond investment, it is crucial to understand the differences between natural and synthetic diamonds. Natural diamonds are more expensive due to their origin and rarity, while synthetics, though similar in appearance, are created in laboratories and generally cost less. The latter may not have the same resale value or appeal to collectors.

For more details on this topic, check out our guide on differences between natural and artificial diamonds.

Natural Diamonds

Natural diamonds form over millions of years under extreme pressure and temperature conditions in the Earth’s mantle. This natural formation makes them extremely rare and valuable. Natural diamonds are often preferred by investors due to their authenticity, durability, and potential to appreciate in value over time. The history and provenance of a natural diamond can also add significant value, especially if they come from recognized and ethically responsible mines.

Synthetic Diamonds

Synthetic diamonds, also known as lab-created diamonds, are produced through processes that replicate the conditions under which natural diamonds form in the Earth. Although these diamonds are chemically and physically identical to natural ones, their market value is lower. Technological advances have made synthetic diamonds increasingly common, which may influence their future value. However, their lower cost can be attractive for certain short-term investments.

Colored Diamonds

In addition to traditional white diamonds, colored diamonds, especially rare ones like red diamonds, are highly valued and sought after. Colored diamonds form when certain chemical elements are present during their formation, giving them unique colors. For example, red diamonds are extremely rare and can reach extraordinary prices in the market due to their beauty and scarcity.

Learn more about red diamonds, one of the rarest and most valuable diamonds.

Factors to Consider When Choosing Diamonds for Investment

Investing in diamonds requires careful evaluation of several factors to ensure your investment is solid and profitable. Here are the key aspects you should consider:

Rarity

The rarity of a diamond is one of the most determining factors of its value. Intensely colored diamonds and large diamonds are especially rare and, therefore, more valuable. The scarcity of these diamonds in the market increases their demand and, consequently, their price.

Intensely Colored Diamonds: Diamonds such as red, blue, and green are extremely rare. For example, red diamonds are among the rarest and can reach exorbitant prices due to their scarcity and visual appeal.

Large Diamonds: Diamonds that exceed 5 carats are much rarer than smaller diamonds. These large diamonds are usually more attractive to collectors and investors due to their notable presence and superior value.

Quality of the 4Cs

The 4Cs — Cut, Color, Clarity, and Carat weight — are the fundamental criteria for evaluating the quality and value of a diamond. Each of these factors significantly contributes to the overall value of the diamond.

Cut: The quality of the cut affects the diamond’s ability to reflect light and, therefore, its brilliance. An excellent cut can significantly enhance the beauty of a diamond, making it appear larger and more brilliant.

Color: Colorless diamonds (grade D on the color scale) are the most valuable. As color becomes more noticeable (from E to Z on the scale), the diamond’s value generally decreases, except in the case of intensely colored diamonds, which can be very valuable due to their rarity.

Clarity: Clarity measures the internal and external imperfections of the diamond. Diamonds with fewer inclusions and defects are more valuable. Clarity grades range from Flawless (without imperfections) to Included (with visible inclusions to the naked eye).

Carats: The carat is the unit of weight for diamonds. One carat equals 200 milligrams. Diamonds with a higher carat weight are rarer and, therefore, more valuable. However, two diamonds of the same carat weight can have different values depending on their cut, color, and clarity.

If you want to learn more about the 4Cs, visit our section – The Quality in 4Cs

Diamond Certification

Ensure that the diamond is certified by a recognized entity such as the GIA (Gemological Institute of America) or the AGS (American Gem Society). Certification provides an independent and accurate assessment of the diamond’s quality, which is crucial for determining its real value. A gemological certificate describes the diamond’s characteristics and guarantees its authenticity, protecting your investment### Diamond Investment

Diamond investment has been valued for centuries due to its durability, intrinsic value, and aesthetic appeal. Diamonds are not only symbols of luxury and status but also tangible assets that can preserve and increase in value over time. This long-standing tradition of investment has been maintained for several key reasons:

- Durability and Stability: Diamonds are extremely hard and resistant, ensuring they maintain their beauty and value over time. This physical durability translates to economic stability, making diamonds less susceptible to rapid devaluation compared to other goods.

- Intrinsic Value: Unlike investments based on fiat currencies or digital assets, diamonds possess intrinsic value. Their rarity and constant market demand ensure that diamonds retain their value over time. Additionally, colored diamonds, especially rare ones like red diamonds, can reach significantly high prices, increasing their appeal as an investment.

- Aesthetic Appeal: The brilliance and clarity of diamonds make them highly desired gemstones. Their visual appeal is not only appreciated in jewelry but also increases their value as collectible items and symbols of wealth.

In this post, we will explore in detail how to invest in diamonds, the key factors you should consider before making a purchase, and answer some frequently asked questions. Our goal is to provide you with the necessary information to make informed and safe decisions when considering diamonds as an investment option.

Why Invest in Diamonds?

Investing in diamonds offers several advantages that make them an attractive option for diversifying and protecting wealth. Here are some of the most important reasons to consider this investment:

Durability and Stability

Diamonds are known for their extreme hardness, being the hardest material on the Mohs scale. This property allows them to resist wear and retain their brilliance and appearance over time. Unlike other assets, diamonds do not deteriorate, ensuring they will maintain their value for many years. Additionally, the stability of the diamond market, despite global economic fluctuations, makes them a safe and reliable investment.

Intrinsic Value

One of the most notable characteristics of diamonds is their intrinsic value. Unlike currencies or real estate, diamonds have a value that does not depend on government decisions or economic conditions. This value comes from their rarity, beauty, and the high constant demand in global markets. Diamonds, especially those of high quality and significant size, will always have a market willing to pay a premium price due to these qualities.

Portability

Diamonds are exceptionally portable compared to other forms of investment. A small stone can have an extremely high value, making it easy to transport and store. This is particularly useful in situations where mobility and discretion are important. Being compact and lightweight, diamonds offer a convenient and safe way to store and transfer large sums of value without the risks associated with transporting large amounts of cash or real estate.

Portfolio Diversification

Investing in diamonds also allows for portfolio diversification. Adding diamonds to a portfolio that includes stocks, bonds, and real estate can reduce overall risk due to the low correlation of diamonds with other financial assets. This diversification protects against losses in a specific market sector, offering greater stability and financial security.

Inflation Protection

Diamonds have proven to be a good protection against inflation. As the value of money decreases, the value of diamonds tends to increase, as the demand for tangible goods like diamonds rises. This means that diamonds can maintain and increase their value in times of inflation, protecting the investor’s purchasing power.

Tax Exemption and Fiscal Benefits

In some countries, diamond investments can offer fiscal benefits. For example, diamonds may be exempt from certain capital gains or inheritance taxes, depending on the jurisdiction. It is important to consult with a tax advisor to understand the specific tax implications in your region, but generally, diamonds can offer additional advantages from a fiscal perspective.

Types of Diamonds for Investment

When considering diamond investment, it is crucial to understand the differences between natural and synthetic diamonds. Natural diamonds are more expensive due to their origin and rarity, while synthetics, though similar in appearance, are created in laboratories and generally cost less. The latter may not have the same resale value or appeal to collectors.

For more details on this topic, check out our guide on differences between natural and artificial diamonds.

Natural Diamonds

Natural diamonds form over millions of years under extreme pressure and temperature conditions in the Earth’s mantle. This natural formation makes them extremely rare and valuable. Natural diamonds are often preferred by investors due to their authenticity, durability, and potential to appreciate in value over time. The history and provenance of a natural diamond can also add significant value, especially if they come from recognized and ethically responsible mines.

Synthetic Diamonds

Synthetic diamonds, also known as lab-created diamonds, are produced through processes that replicate the conditions under which natural diamonds form in the Earth. Although these diamonds are chemically and physically identical to natural ones, their market value is lower. Technological advances have made synthetic diamonds increasingly common, which may influence their future value. However, their lower cost can be attractive for certain short-term investments.

Colored Diamonds

In addition to traditional white diamonds, colored diamonds, especially rare ones like red diamonds, are highly valued and sought after. Colored diamonds form when certain chemical elements are present during their formation, giving them unique colors. For example, red diamonds are extremely rare and can reach extraordinary prices in the market due to their beauty and scarcity.

Learn more about red diamonds, one of the rarest and most valuable diamonds.

Factors to Consider When Choosing Diamonds for Investment

Investing in diamonds requires careful evaluation of several factors to ensure your investment is solid and profitable. Here are the key aspects you should consider:

Rarity

The rarity of a diamond is one of the most determining factors of its value. Intensely colored diamonds and large diamonds are especially rare and, therefore, more valuable. The scarcity of these diamonds in the market increases their demand and, consequently, their price.

Factors to Consider When Choosing Diamonds for Investment

Investing in diamonds requires careful evaluation of several factors to ensure that your investment is solid and profitable. Here are the key aspects you should consider:

Rarity

The rarity of a diamond is one of the most determining factors of its value. Intensely colored diamonds and large diamonds are especially rare and, therefore, more valuable. The scarcity of these diamonds in the market increases their demand and, consequently, their price.

Intensely Colored Diamonds: Diamonds such as red, blue, and green are extremely rare. For example, red diamonds are one of the rarest and can reach exorbitant prices due to their scarcity and visual appeal.

Large Diamonds: Diamonds that exceed 5 carats are much rarer than smaller diamonds. These large diamonds are often more attractive to collectors and investors due to their notable presence and superior value.

Quality of the 4Cs

The 4Cs — Cut, Color, Clarity, and Carats — are the fundamental criteria for evaluating the quality and value of a diamond. Each of these factors significantly contributes to the overall value of the diamond.

Cut: The quality of the cut affects the diamond’s ability to reflect light and, therefore, its brilliance. An excellent cut can significantly enhance the beauty of a diamond, making it appear larger and more brilliant.

Color: Colorless diamonds (grade D on the color scale) are the most valuable. As color becomes more perceptible (from E to Z on the scale), the value of the diamond generally decreases, except in the case of intensely colored diamonds which can be very valuable due to their rarity.

Clarity: Clarity measures the internal and external imperfections of the diamond. Diamonds with fewer inclusions and defects are more valuable. Clarity grades range from Flawless (no imperfections) to Included (with inclusions visible to the naked eye).

Carats: Carat is the unit of weight for diamonds. One carat is equal to 200 milligrams. Larger carat weight diamonds are rarer and, therefore, more valuable. However, two diamonds of the same carat weight can have different values depending on their cut, color, and clarity.

If you want to know more about the 4Cs, visit our section –The Quality in 4Cs

Diamond Certification

Make sure the diamond is certified by a recognized entity such as GIA (Gemological Institute of America) or AGS (American Gem Society). Certification provides an independent and accurate assessment of the diamond’s quality, which is crucial for determining its real value. A gemological certificate describes the characteristics of the diamond and guarantees its authenticity, protecting your investment.

Recognized Certifying Entities:

- GIA: The Gemological Institute of America is one of the most prestigious and trustworthy entities for diamond certification.

- AGS: The American Gem Society is another respected entity that provides detailed and accurate certifications.

Ethical Origin of Diamonds

The demand for ethical and conflict-free diamonds has significantly increased. Diamonds that come from conflict-free sources and ethical mining practices are increasingly valued by consumers and may have a higher demand in the market. These diamonds are mined responsibly, ensuring that local communities benefit and that no armed conflicts are funded.

Ethical Origin Certifications:

- Kimberley Process: An international certification system that ensures diamonds do not finance conflicts.

- Canadian Mark Diamonds: Diamonds mined in Canada that meet strict ethical and environmental standards.

When choosing diamonds for investment, it is essential to consider rarity, the quality of the 4Cs, certification, and ethical origin. These factors not only ensure that you are acquiring a high-quality diamond but also maximize the appreciation potential of your investment. Conduct thorough research and consult gemology experts to make informed and secure decisions.

How to Buy Diamonds for Investment

Buying diamonds for investment requires meticulous attention to several factors to ensure that your purchase is safe and beneficial. Below are the key aspects you should consider:

Choosing a Supplier

Reliable Suppliers: It is essential to buy diamonds from reliable suppliers who offer certifications and guarantees. Look for sellers with a solid reputation in the market and verify their credentials.

Reputation and Experience: Opt for suppliers with a long track record and good reviews. Research their history and consult other customers for references.

Certifications: Ensure that the supplier offers diamonds certified by recognized entities such as GIA or AGS, which guarantees the authenticity and quality of the diamonds.

Authenticity Verification

Lab Reports: Use independent lab reports to verify the authenticity of the diamond. These reports should provide details about the 4Cs (Cut, Color, Clarity, and Carats) and any unique features of the diamond.

Detection Tools: There are technological tools that can help identify fake or treated diamonds. These include devices that use ultraviolet light, X-rays, and other advanced techniques.

Consultations with Gemologists: Consider consulting professional gemologists who can provide an independent and expert evaluation of the diamond.

Legal Aspects

Tax Implications: Learn about the tax laws in your country regarding the purchase of diamonds. Some jurisdictions may impose taxes on capital gains when you sell your diamonds.

Import/Export Regulations: If you are buying diamonds from international suppliers, make sure to comply with import and export regulations. This includes compliance with the Kimberley Process to avoid purchasing conflict diamonds.

Documentation and Insurance: Keep all documentation related to the purchase and certification of your diamonds. Consider insuring your diamonds to protect your investment against theft or damage.

Storage and Care of Diamonds

Storage Methods

Safety Boxes: Use safety boxes or bank vaults to protect your investments from theft and damage. These options offer a high level of security and peace of mind.

Controlled Environments: Store diamonds in environments where temperature and humidity are controlled to avoid damage. Avoid exposing them to extreme conditions.

Insurance: Insure your diamonds to cover potential losses or damage. Look for policies that offer comprehensive coverage and ensure that the insured value is up-to-date.

Maintenance of a Diamond

Regular Cleaning: Clean your diamonds regularly with specific products to maintain their shine and prevent the buildup of dirt and oils. Use solutions designed for diamonds or warm water with mild soap.

Proper Storage: Store diamonds in individual cases to prevent them from scratching each other. Use jewelry boxes with separate compartments.

Periodic Reviews: Take your diamonds to a professional jeweler for periodic reviews. This ensures that the stones are securely set and in good condition.

How to Sell Diamonds

When to Sell the Diamonds We Have Invested In

Market Evaluation: Evaluate the market and consult experts to determine the best time to sell. Diamond prices can fluctuate, and selling at the right time can maximize your profits.

Economic Conditions: Consider the general economic conditions. In times of economic uncertainty, diamonds can maintain or increase their value, making them an attractive sale.

Personal Needs: In addition to the market, your personal needs and financial goals should also influence the decision to sell.

Where to Sell a Diamond

Auctions: Consider selling at auctions specializing in diamonds and luxury jewelry. Auctions can attract buyers willing to pay premium prices for exceptional pieces.

Specialized Retailers: Sell to specialized diamond retailers who offer fair prices and a transparent sales process.

Online Platforms: Use reliable online platforms to sell your diamonds. These platforms can offer a wide audience and a convenient sales process.

Evaluation and Certification: Before selling, make sure your diamonds are evaluated and certified. This provides potential buyers with confidence in the authenticity and quality of the stones.

Frequently Asked Questions about Diamond Investment

What Makes Diamonds a Good Investment?

Diamonds are valuable due to their rarity, durability, and market stability, offering a store of value in times of economic uncertainty.

What are the Risks of Investing in Diamonds?

Risks include market fluctuations, difficulty in assessing the real value without experts, and potential liquidity issues.

How is the Value of a Diamond Determined?

The value is primarily determined by the 4Cs (Cut, Color, Clarity, and Carats) and certification by a recognized entity.

Is it Better to Invest in Natural or Synthetic Diamonds?

Although synthetic diamonds are more affordable, natural diamonds are often more valuable and appreciated, especially in the luxury market. More details in our guide on the differences between natural and synthetic diamonds.

What are Colored Diamonds and Why are They Valuable?

Colored diamonds, such as red ones, are extremely rare and valued for their uniqueness. Learn more about red diamonds.

Where Can I Buy Reliable Diamonds?

It is recommended to buy from certified and recognized suppliers, who offer guarantees and quality certifications.

Conclusion on How to Invest in Diamonds

Investing in diamonds offers a unique combination of durability, intrinsic value, aesthetic appeal, and potential for appreciation, making them an attractive option to diversify and protect your assets. By considering key factors such as the quality of the 4Cs, rarity, certification, and ethical origin, you can ensure a solid and profitable investment. Additionally, knowledge of the market, choosing reliable suppliers, and proper storage and maintenance are essential to maximize the value of your investment. With the right information and precautions, diamonds can be a valuable addition to your investment portfolio.